•

12-minute read

| Linking websites | N/A |

| Backlinks | N/A |

| InLink Rank | N/A |

SEO and marketing strategies of any business are determined by the competitive environment the business operates in. What’s more, this strategy is not formed once and forever — it changes and evolves together with the market as time goes by. That’s why competitive research is a thing of key importance for any business.

Real competitive research goes far beyond simply checking competitors’ keywords and backlinks. Still, very few businesses understand what tremendous information could be found by just looking around. And we are here to do this now and dig deeper into the matter.

The biggest mistake a business can make is to think that its competitors are the direct ones only, i.e. the businesses that offer the same goods and services to the same audience.

The truth is that your market is way bigger. And it’s crucial to understand the three levels of your competitive ecosystem.

Different sources call these groups differently, but the idea is actually the same:

The best way to actually start your competitive research is to just remember a couple of your primary and secondary competitors. Then run their websites through various competitor research tools to get a set of similar businesses.

For example, Similarweb offers you a nice set of insights for a website, including traffic stats and the list of competitors and similar websites.

Still, there’s an issue — if the website you’re checking is too small and unpopular yet, there are high chances that the tool will just return the N/A results as it doesn’t have enough data.

Metrica and SpyFu work practically the same — you enter the website and get a set of SEO and PPC data, including the list of competitors.

Also, you can run the websites you’ve collected through Rank Tracker’s Domain Competitors (Competitor Research module) to see which of them rank for the same keywords.

Then combine all the websites you have collected into one table and inspect each of them in detail to see if you are competing within the same price segment and audience. Chances are that this table will turn out to feature some of your indirect competitors as well. Yet most of them are to be defined based on mere logic and common sense. Think about what needs clients would satisfy with your product, and think of all the alternative ways these needs could be satisfied with.

Understanding different levels of competition doesn’t give us much by itself, but it is crucial for further research.

While it is likely that the promotion methods, traffic channels, and ad placements successfully used by your direct competitors will also work for you, the same isn’t true about your secondary competition. Blindly repeating their marketing steps is likely to waste your budget, as the audience these businesses target is different from yours.

Indirect competitors, in their turn, are a great source of inspiration and a means of broadening your target audience.

One more basic approach to analyzing the competitive landscape is to check its structure. According to how many competitors are present on the market, industries could be classified as consolidated and fragmented.

A market is consolidated when several bigger players overtake most of the market.

When the market is divided more or less equally among many businesses, and these businesses are pretty equal, too, then this market is fragmented.

At first, you can use Similarweb’s traffic stats to get a surface understanding of what your market is. Take the list of your direct competitors and try to calculate their market share by dividing each competitor’s traffic by the total traffic of all the competitors from your list.

While you can get the competitor’s traffic stats from Similarweb (the image above), you’ll have to calculate the total traffic and the market share manually in Excel or Google Sheets.

If your industry is pretty small, and Similarweb doesn’t feature enough data, you can make the same calculations based on the monthly volume of branded searches. Or you can even compare the brands’ names in Google Trends.

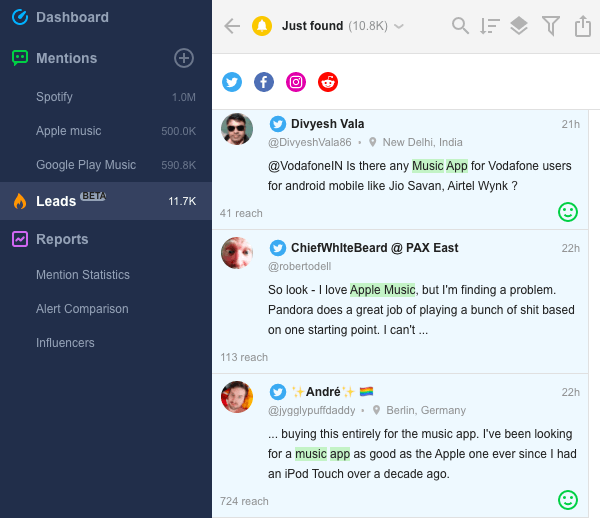

You can also track and compare the number of brand mentions on social media. For example, with the help of Awario.

Traditionally, a consolidated market is considered much harder to enter. As it’s already full of big players, which means big money, too.

In most cases, new small businesses won’t be able to afford PPC advertising on the consolidated market, as the bids are overheated by big players. This makes the acquisition cost too high for young businesses. A good example, in this case, is the tourism industry, where giants like Booking.com and Airbnb made the cost per click way too big for any business smaller than these moguls.

SEO wise, on the contrary, a consolidated industry might pose an extra opportunity. Even though the top positions for your main keywords are firmly occupied by huge brands, a smaller number of competitors means less competition for long-tail keywords.

As for the fragmented market, customer acquisition costs are lower here, as a rule, so you’d probably succeed with paid traffic. But when it comes to organic promotion, things don’t seem quite easy here. As there are many players, it will be hard to find the content topic not covered by anyone yet, thus SEO promotion gets harder.

Still, you can take advantage of someone else’s authority and influence by getting featured in authoritative media. As the overall level of your competitors is far from high, the publication will most probably rank easily and keep bringing you stable traffic flows for quite a long time.

It’s crucial to understand where most of your targeted audience hangs out. And competition traffic research is an obvious shortcut here.

The first thing to pay attention to is the competitor’s source of the heaviest traffic.

At the same time, you have to pay attention to the traffic sources that seem to bring from little to no traffic and find out why.

For starters, you can track your competitor’s traffic sources with Similarweb. The bar graph will give you an overview of where the traffic comes from, identifying what sources bring the most of it. If the numbers more or less repeat across most of your competitors, this lets you see the industry’s averages and predict your own traffic potential.

You can also use the Metrica tool. Same as Similarweb, it can give away many useful insights for free, including those about traffic sources.

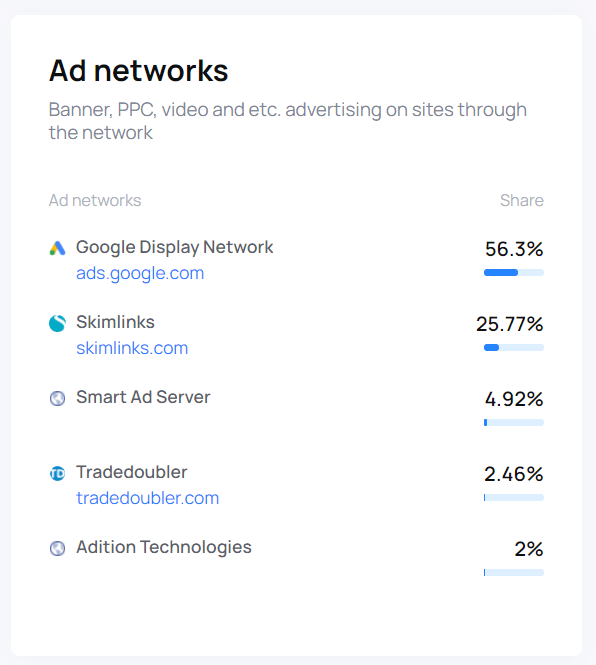

And the sources of paid traffic, too.

To get more insights into paid traffic, you can use SpyFu.

First, you have to understand where the heaviest source of your target audience is. I.e. identify where the majority of your competitors get a steady traffic flow from.

Say, your competitors get the most of their traffic from social media. Go and check their accounts manually — maybe it’s Instagram (Twitter, Reddit, TikTok, etc.) that is the key to success in your industry. Or vice versa, social media brings your competitors little to no traffic. Which probably indicates social media should not play a major role in your marketing strategy.

Although you’ll have to study all the sources in detail to find any neglected opportunities, there’re usually very few surprises here. The heaviest source of competitors’ traffic will point to where you should direct your efforts as well.

Before you start thoroughly optimizing your website for search, you’ll need to know how much traffic your business can get, i.e. what is the maximum traffic share you can take. Potential traffic to win is what justifies the SEO costs, so this part is of double importance if you’re doing competitive research for clients.

There are several ways for you to check potential SEO share of voice.

If you’re super pressed for time, a quick and “dirty” estimate is to simply figure out which of the competing websites you will likely beat in backlink authority in a couple of months from now. And assume that their total organic traffic will turn into your traffic as a result.

To dig deeper and get a more precise traffic prediction, you’ll need to start with keyword research.

For every keyword you will then check:

I like how Rank Tracker’s Keyword Difficulty tab comes in handy here. I decide on which Page Strength level I consider achievable for my own pages. And then switching between different keywords, I check on which position I hope to get for each of them.

Then I multiply the number of searches by the predicted position’s CTR, and get my future traffic estimated. Summed up for all of the keywords, the figures give me the total organic traffic I’m planning to fight for with my SEO campaign.

To account for zero-click searches, you can also check for SERP features:

A SERP may feature many attention luring blocks like news, videos, knowledge panels, etc., like in the image below.

In this case, the number of your potential clicks gets lower (unless you make it to SERP features).

Organic traffic potential is what lets you decide whether SEO is worth the while for your particular niche and business.

It may happen that the organic potential is quite low, but the costs per click are pretty affordable even for you. Then it may be a good idea to rely on PPC and other means of paid promotion more than on SEO.

On the contrary, huge SEO potential isn’t something you’d want to ignore. So you might decide on cutting your advertising costs to increase the SEO budget.

While SEO requires money invested, it is the so-called “one-time” investment - when finally on position #1, you’ve secured yourself a flow of organic clicks you don’t have to pay for.

But things are different with PPC. In this case, every single click costs you money. That’s why you have to make sure these paid clicks have a positive ROI. In other words, to see if you can afford to buy clicks and stay afloat.

When it comes to unit economics and PPC, we base the calculation on the two metrics:

Eventually, the cost per click must be lower than the revenue per client multiplied by the conversion rate.

For example, a client brings you $20, and the conversion rate is 15%. In this case, a click has to cost you $3 or less for your business to get profit or at least not to spend ad budgets in vain.

Now, knowing the cost per click you can afford, your next step is to go and check the actual click costs in your industry. If you’ve been using Rank Tracker for keyword research, you can use the tool for the PPC analysis as well.

One more way to check competitors’ keywords and their bids is SpyFu:

The conclusions here are always quite straightforward. If there are traffic-bringing keywords you can afford — then you launch an advertising campaign. If there are no affordable keywords with traffic potential — you have to find other traffic sources. That is it.

Once you define your promotion strategy, evaluate your potential, and form a basic plan of actions, you’re going to start your SEO routine. And this is where your high-level competitive landscape analysis gives place to the SEO strategy drill-down.

If you don’t have your keyword map built yet, consider cutting corners with competition research. Simply enter your competitors’ domains into Rank Tracker’s Keyword Gap module:

The tool will find and show you all the keywords your competitors’ websites have ever appeared in search for.

The keywords found this way have already been tested by your competitors and bring them traffic, so the guesswork may be put aside.

Finding keywords is only the first step on the way to content creation. Your next step is figuring out the search intent of your newly found keywords to target each with the right type of content.

All in all, there are four types of search intent keywords may have:

And for each of the search intents, Google tunes the search results accordingly. As a rule, informational keywords trigger different guides and how-to’s, investigational ones trigger listicles, and the best fit for transactional keywords are product pages.

However, in most cases, you can not identify the search intent by simply looking at a keyword. Sometimes Google is likely to see things differently. So to get a better idea of what search results are likely to show up for each of your keywords, you need to investigate the SERPs themselves. And your competitors’ pages that already rank for them.

Here I once again suggest going to Rank Tracker’s Keyword Difficulty tab to quickly review the top 10 pages for all of your keywords.

From here, you can check the URLs manually to see what content they feature. Based on your findings, group the keywords by intent, and create suitable types of content for each of them.

Another way to use competitor intelligence in SEO, is to reverse-engineer their on-page optimization techniques.

Even though you will frequently hear about Google’s ability to understand context, process natural language, use AI and so on…Keywords are still one of the most important indicators of a page’s relevance. And to get your page ranking for a certain keyword, you need to make sure it is no less “relevant” to the keyword than the rest of the competing pages.

And this is where we refer to our competition.

In content optimization tools like WebSite Auditor you’ll have your competitors’ keyword optimization stats analyzed to give you the exact content optimization guidelines to follow:

Watch this quick video tutorial to see how to write SEO-friendly content with WebSite Auditor.

Backlinks are one of the key aspects of any SEO strategy. You will not be ranked high without them. So it is reasonable to explore where your competitors take them from.

You can do this with SEO SpyGlass. Go to Domain Comparison > Link Intersection and enter your competitors’ domains. Pay attention to the websites that provide dofollow backlinks to several competitors of yours but not yet to you — this means that they would be more willing to give one to you. And pay attention to the Domain InLink Rank metric. The higher it is, the better.

Tip.You can also use SEO SpyGlass to spot the most popular content of your competitor and reverse engineer it to get more links.

Even though competitive SEO research is pretty complicated, when done right, it gives you a clear picture of where to move in terms of your business promotion. Keep in mind that this process is actually never-ending — you’ll have to regularly monitor your competitors and the overall state of the market. Otherwise, you may miss the moment when a new competitor enters your niche and starts taking the traffic and clientele that might have been yours.

What things do you pay attention to when researching the market and competitors? Share your experience in the comments.